Japan is one of the most attractive places for R&D activities. Multinational corporations like Apple are launching R&D centers in Japan where you can get access to talented engineers.

The government made a fine tune on the R&D Tax Credit Program [1], which have been playing a significant role in attracting innovative foreign corporations. New incentives will cover R&D in IoT, AI, and big data. SMEs should be aware of and apply for more powerful R&D Tax Credit Program for SMEs [2] to stimulate innovation and boost competitiveness. Plus, the government provides the Open Innovation Program [3], a strong incentive for corporations who collaborate with specific organizations and universities. Check this out.

[1] R&D Tax Credit Program (as of Apr 2017)

What are R&D expenses?

In addition to the traditional R&D expenses in manufacturing industry, new program extends to the expenses in the 4th industrial revolution type services like big data services.

Government shows some unique examples.

Notification services providing more detailed and real-time natural disaster prediction by combining and analyzing image data and weather data collected using drone.

Information services distributing agricultural support information that farmers can do optimal farming work, which are provided by combining data of agricultural products and soil and weather data.

Advisory services proposing suitable fitness plan, recommendation of dietary habits or hospitalization by analyzing individual health data including exercise, sleeping situation, meal, body weight, heart beating rate, etc.

Information services for tourists providing precise prediction of rarely-happening precious natural phenomena like aurora and whales by analyzing weather and ecological data and image data collected using drone.

Standard tax credit

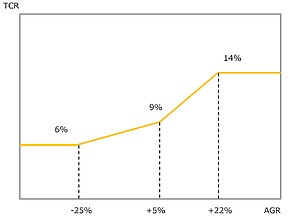

Tax credit rate (TCR) is 6% – 14% of R&D expenses, which will be deducted from federal income tax.

Keep higher average growth rate (AGR1) of R&D cost, and higher TCR is applicable.

Capped with 25% amount of federal income tax

Average growth rate (AGR): Increase rate compared to the average R&D cost over the past 3 years

Additional tax credit

You can enjoy additional tax credit program of either;

Cap Extension:

If R&D/Revenue ratio (RRR) is more than 10%, cap is extended up to 35% amount of federal income tax. [RRR – 10%] × 2 is added up to 35%.

High Level R&D:

If RRR is more than 10%, additional tax credit on excessive portion can be granted. [R&D expenses – (Average revenue × 10%) ] × [RRR – 10%] × 0.2 is added to tax credit, capped with 10% amount of federal income tax.

[2] R&D Tax Credit Program for SMEs (as of Apr 2017)

The higher tax credit rate and the more-easily-triggered cap extension are offered to SMEs. In addition, R&D tax credit applies to regional income tax as well.

Who are SMEs?

In R&D incentive programs, you fall on SEM category if the company do not meet all the conditions below:

Capital amount is more than 100 million;

A majority of shares is held by one corporation with capital amount of more than 100 million yen.

More than two thirds of shares are held by two or more corporations with capital amount of more than 100 million yen.

Standard tax credit

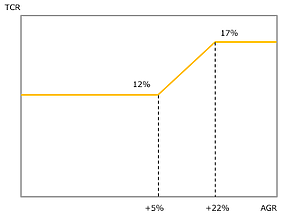

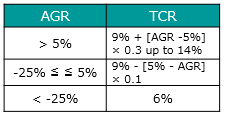

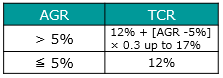

Tax credit rate (TCR) 12% – 17% of R&D expenses will be deducted from federal income tax

Keep higher average growth rate (AGR1) of R&D cost, and higher TCR is applicable.

Capped with 25% amount of federal income tax

Additional tax credit

You can enjoy additional tax credit program of either;

Cap Extension:

If AGR is more than 5%, tax credit is Capped with 35% amount of federal income tax.

High Level R&D:

If R&D/Revenue ratio (RRR) is more than 10%, additional tax credit on excessive portion can be granted.

[R&D expenses – (Average revenue × 10%) ] × [RRR – 10%] × 0.2 is added to tax credit, capped with 10% amount of federal income tax.

[3] Open Innovation Program

Strong incentives are provided for corporations who collaborate with specific organizations and universities.

Collaborative research study expenses and R&D contracting fees will be covered.

Tax credit rate (TCR) is as high as 20% – 30% of R&D expenses, which will be deducted from federal income tax.

Capped with 5% amount of federal income tax

Expenses applied to the Open Innovation Program cannot be applied for R&D Tax Credit Program mentioned above.